Everyone loves a big top line. Yet the revenue vs profit debate exposes a stubborn truth: sales alone don’t pay the bills, fund innovation, or return capital. “Revenue is just an ego number. Profit is the only number that matters” resonates because investors, acquirers, and employees ultimately depend on what’s left after costs. From Amazon’s massive 2024 figures to a decade of UK retail strain, the data shows why executives must pivot from celebrating turnover to managing margins, unit economics, and cash.

Key Takeaways

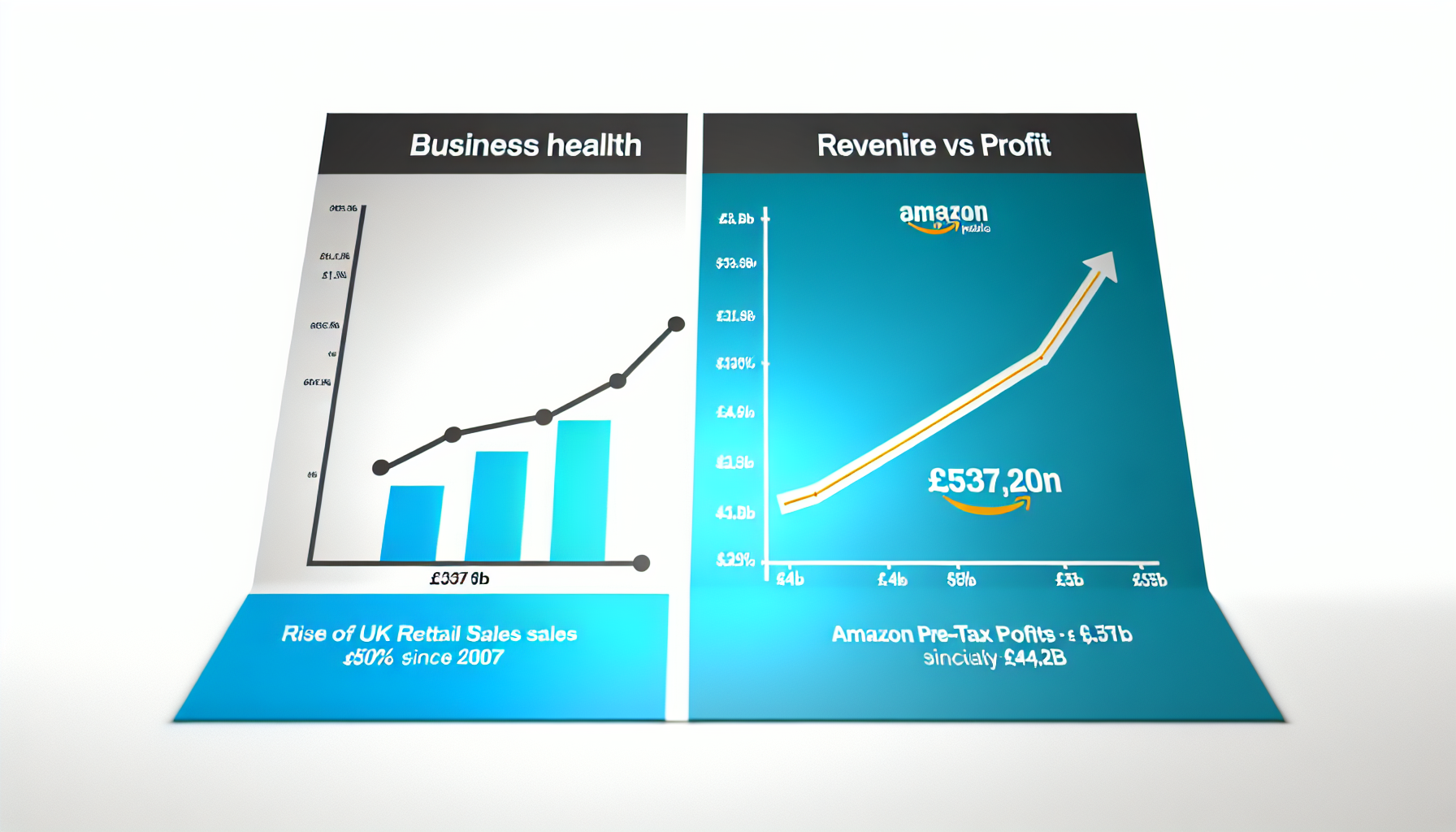

– shows UK retail sales climbed ~50% from £125bn (2007) to >£190bn, while pre-tax profits shrank from £6.5bn to ~£4bn, exposing margin erosion. – reveals Amazon’s 2024 revenue hit $637.96bn against $59.25bn net profit—about 9.3% net margin—highlighting the gulf between top line and bottom line. – demonstrates adding 5 percentage points to annual revenue growth correlates with 3–4 points higher TSR across 5,000 large firms—when profits scale too. – indicates EBITDA-led, recurring-revenue models attract stronger exit multiples than pure sales volume; a 2016 analysis prioritizes earnings quality over headline growth. – suggests founders replace vanity metrics with unit economics; a 2010 HBR warning anchors profitability on validated learning, not raw gross revenue.

Revenue vs profit: why the top line can deceive

Revenue is the “top line”—the sum of goods and services sold before costs. Profit is the “bottom line”—what remains after COGS, operating expenses, interest, taxes, and non-cash charges. A firm can shout about record sales and still destroy value if acquisition costs, logistics, or discounts erode profitability. Investopedia captures the distinction and notes Amazon’s 2024 revenue of $637.96 billion versus $59.25 billion in net profit, a reminder that expenses, taxes, and COGS drive real earnings [1].

The math clarifies the stakes. If each dollar of revenue yields only a thin net margin, then scale without discipline amplifies losses or underwhelming returns. Conversely, a company with moderate growth but expanding gross and operating margins can create more free cash flow per unit of sales, outpacing peers in resilience and valuation.

Revenue vs profit in practice: Amazon’s 2024 math

Amazon’s 2024 snapshot illustrates how headline revenue can mask the cost machine beneath it. At $637.96 billion of sales and $59.25 billion of net income, the company’s net margin is roughly 9.3%. That means each $1 of revenue ultimately produced about $0.093 of profit after all costs. The spread between the top line and bottom line underscores why investors scrutinize segment mix, logistics efficiency, and operating leverage.

The strategic lesson is simple: profitable segments (e.g., cloud, advertising) can subsidize lower-margin businesses but only up to a point. Sustainable value creation requires driving mix toward higher contribution margins, trimming CAC and fulfillment costs, and converting earnings into cash. Growth supported by operating discipline elevates both resilience and investability.

When turnover rises but profits fall: UK retail’s lesson

UK retail data puts numbers to the proverb “turnover is vanity, profit is sanity.” From 2007 to 2019, sector sales rose from about £125 billion to over £190 billion—roughly 50% growth—while pre-tax profits fell from £6.5 billion to around £4 billion, showing margins compressed even as tills rang louder [5].

That divergence speaks to intensifying discounting, rising occupancy costs, wage inflation, and an omnichannel shift that piled logistics and returns onto already thin bricks-and-mortar margins. Many retailers leaned on promotions to defend revenue share, only to sacrifice operating income and cash conversion.

The implied sector pre-tax margin shrank materially: roughly 5.2% in 2007 (£6.5bn on £125bn) versus about 2.1% in 2019 (£4bn on £190bn). In other words, the industry engineered more sales but harvested less profit per pound—an unmistakable signal that revenue growth unmoored from margin discipline destroys economic value over time.

Beware vanity metrics: what founders should measure instead

Founders and operators often default to easy-to-celebrate numbers—gross revenue, app downloads, unique visitors—that say little about viability. Eric Ries’s guidance on “vanity metrics” urges teams to tie measurement to validated learning, cohort retention, price sensitivity, and unit economics, not applause lines. Progress is proving repeatable value creation with data, not stacking raw top-line figures [2].

If a customer costs more to acquire and serve than they contribute over their lifetime, revenue expansion magnifies losses. Replace vanity metrics with a dashboard aligned to profitability: contribution margin per unit, blended CAC and payback, LTV by cohort, gross-to-net revenue bridges, and cash conversion cycle. These illuminate whether growth is self-funding—or subsidized by dilution and debt.

Revenue vs profit and growth: what shareholders actually reward

Shareholders don’t reject growth; they prize profitable growth. McKinsey’s research on the 5,000 largest companies finds that adding five percentage points of annual revenue growth correlates with three to four percentage points higher total shareholder returns—when ROIC and margins keep pace [3].

The synthesis: velocity matters, but economics matter more. Companies that compound revenue while holding or expanding gross margin, operating margin, and ROIC tend to convert growth into rising TSR. Those that buy growth through uneconomic pricing, undisciplined sales spend, or capital-intensive expansion watch value creation slip away even as revenue charts point up.

Crucially, persistent market leaders couple growth with discipline: pricing power, mix shift to higher-margin SKUs or services, and operating leverage that scales overhead slower than revenue. That is how top-line expansion becomes bottom-line compounding.

Profit drives exit value, not headline revenue

Acquirers underwrite future cash flows, not press releases. Forbes warns that owners who chase top-line scale often meet “disappointed acquisition multiples” because buyers pay for EBITDA, recurring revenue quality, and capital efficiency. The advice: convert growth into durable earnings—recurring models with strong margins—if you want premium valuations [4].

Practically, that means standardizing offerings to lift gross margin, shifting mix toward subscription or contracted revenue, and building a cost structure that scales efficiently. A $100 million-revenue business with 25% EBITDA and low churn can command far better multiples than a $150 million seller with 5% EBITDA and volatile demand.

How to report smarter: practical metrics beyond revenue

Leaders can future-proof reporting by focusing on metrics that connect execution to economics. Consider adding these to board packs and investor updates: – Gross margin and contribution margin by product, channel, and cohort – LTV/CAC and payback period by segment and campaign – Net revenue retention and churn (logo and dollar) – Operating margin, EBITDA margin, and free cash flow conversion – ROIC, asset turns, and cash conversion cycle – Cohort profitability and time-to-breakeven for new launches – Price realization and discount leakage tracking – Mix shift analysis toward higher-margin SKUs, geographies, or segments

The goal is not to bury teams in dashboards. It is to elevate the few metrics that predict whether today’s growth funds tomorrow’s strategy without external lifelines.

Revenue vs profit: a checklist for leaders and boards

– Is revenue growth accretive to gross and operating margins, or masking rising discounting, returns, and service costs? – Are we acquiring customers with LTV meaningfully higher than CAC, within payback periods that protect cash? – Does our mix shift deliberately toward higher-contribution products or segments? – Are we converting EBITDA into cash, or piling up receivables and inventory? – How does ROIC compare to our cost of capital, and are we compounding both revenue and returns? – What vanity metrics can we retire in favor of validated learning and unit economics?

The bottom line on revenue vs profit

Revenue opens doors; profit keeps them open. The evidence—from Amazon’s nine-percent-ish net margin on giant sales to UK retail’s 50% sales rise amid falling profits—argues for disciplined growth. Investors reward companies that scale both the top and bottom lines, translating traction into returns. Celebrate revenue when it is a leading indicator of profit, not a substitute for it. The scoreboard that matters is sustainable earnings and cash.

Sources:

[1] Investopedia – Revenue vs. Profit: What’s the Difference?: https://www.investopedia.com/ask/answers/122214/what-difference-between-revenue-and-profit.asp

[2] Harvard Business Review – Entrepreneurs: Beware of Vanity Metrics: https://hbr.org/2010/02/entrepreneurs-beware-of-vanity-metrics [3] McKinsey & Company – The ten rules of growth: www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-ten-rules-of-growth” target=”_blank” rel=”nofollow noopener noreferrer”>https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-ten-rules-of-growth

[4] Forbes – Why Your Business’ Revenue Is Really A Vanity Metric: www.forbes.com/sites/johnwarrillow/2016/12/26/why-your-business-revenue-is-really-a-vanity-metric/” target=”_blank” rel=”nofollow noopener noreferrer”>https://www.forbes.com/sites/johnwarrillow/2016/12/26/why-your-business-revenue-is-really-a-vanity-metric/ [5] Knight Frank – Turnover is vanity, profit is sanity — retail’s oldest proverb: www.knightfrank.com/your-space/2019-05-17-turnover-is-vanity-profit-is-sanity-retails-oldest-proverb-research” target=”_blank” rel=”nofollow noopener noreferrer”>https://www.knightfrank.com/your-space/2019-05-17-turnover-is-vanity-profit-is-sanity-retails-oldest-proverb-research

Image generated by DALL-E 3

Leave a Reply